Efficient Frontier

Table of contents

Challenges of Traditional

Portfolio Management in Crypto

Evai ratings are designed to help investors pick the best crypto assets portfolios. Traditional portfolio management focuses on balancing risk and profitability by selecting a mix of assets.

However, this approach faces unique challenges in the crypto market:

Adapting Portfolio Management

to Crypto Market Dynamics

To address these challenges, EVAI has chosen a more nuanced approach to portfolio construction is needed in the crypto space. This includes:

Key Concepts

Evai ratings are designed to help investors pick the best crypto assets portfolios. Traditional portfolio management focuses on balancing risk and profitability by selecting a mix of assets.

However, this approach faces unique challenges in the crypto market:

Understanding the Q-Function

in Evai Ratings

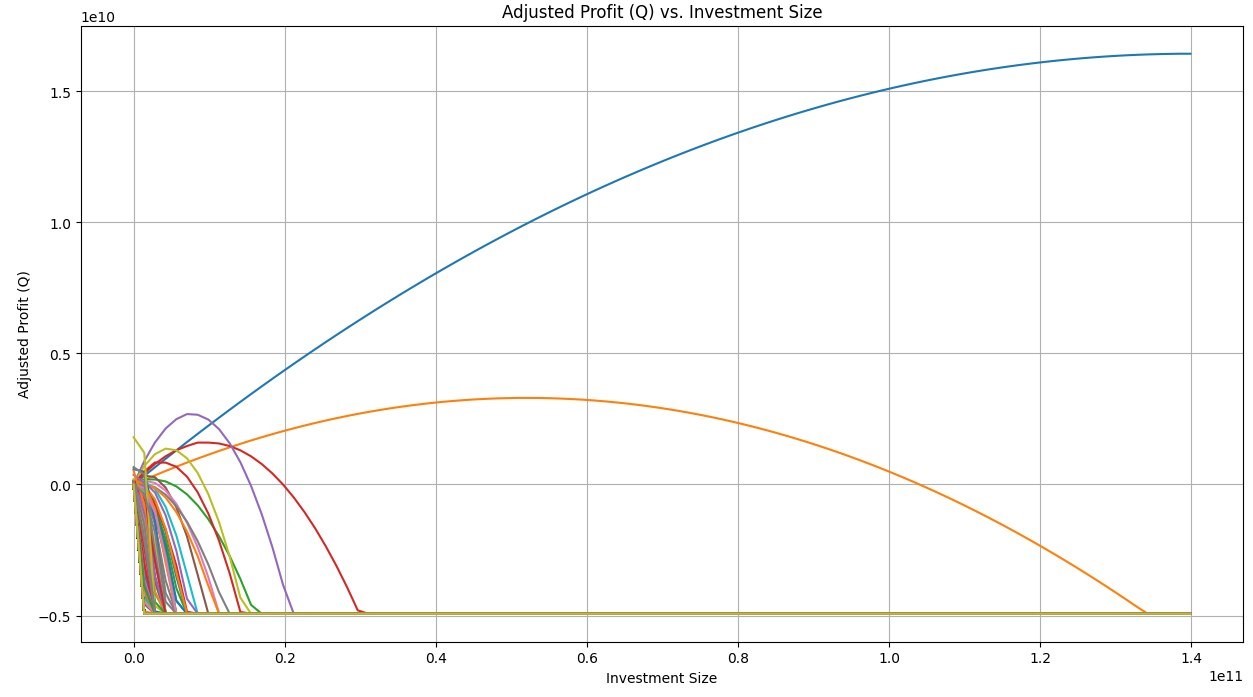

The Q-function is a core part of Evai's system to determine the potential return on your investment in a cryptocurrency.

Here's a simple breakdown:

1. Profitability

The expected and historical returns from the asset.

2. Risk Factors

Adjustments based on the risk associated with the asset, which depends on market size and volatility.

3. Risk Tolerance

The Q-function balances the expected ROI with the investor's risk tolerance. This means it factors in how comfortable you are with the fluctuations in small or large markets.

4. Market Dynamics

It adjusts the expected return on investment (ROI) by considering market slippage (how much the price moves when you trade) and liquidity (how easy it is to buy or sell large amounts). More liquid assets are preferred. Lower slippage for the asset, especially with large investments, is better. Market Cap feature is also taken into consideration as well, - the smaller the market cap, the more likely the prices will fluctuate wildly.

5. Investment Size

Different outcomes for small vs. large investments.

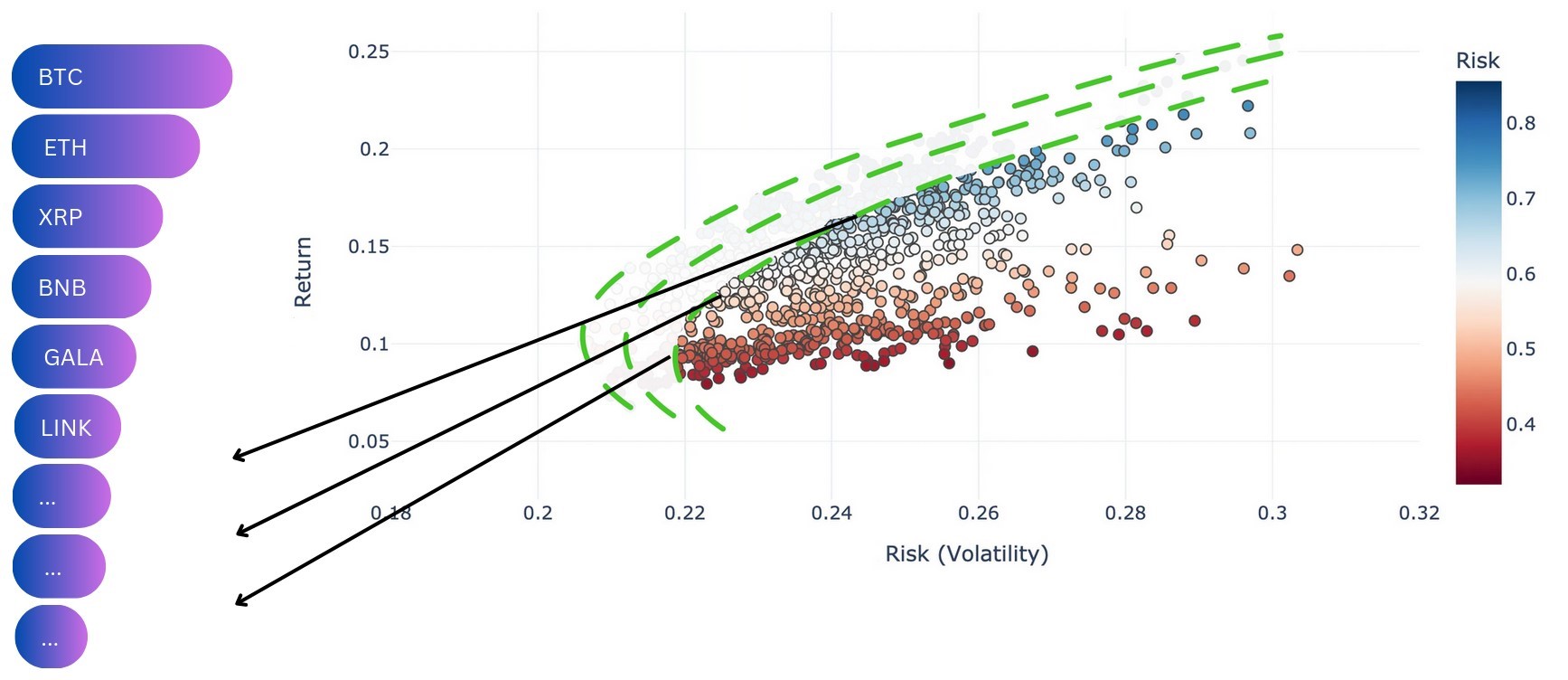

Figure 1. - Q-value functions for the top 800 crypto markets.

Making Sense of the Q-Matrix

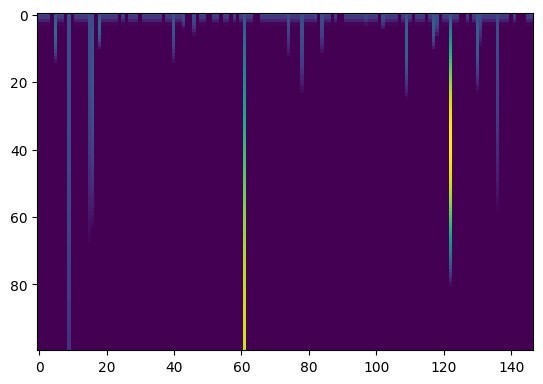

The Q-matrix extends the Q-function across all cryptocurrencies in Evai's system.

Unlike traditional assets, cryptocurrencies tend to be highly correlated and extremely volatile. This means their prices often move in similar patterns and can change rapidly.

Crypto investors often have different expectations and risk tolerance compared to traditional investors.

Many cryptocurrencies have uneven liquidity distribution, posing challenges for medium and large investors who might significantly impact market prices due to the limited availability of assets.

Figure 2. - Q-values matrix representation for the top 147 crypto markets.

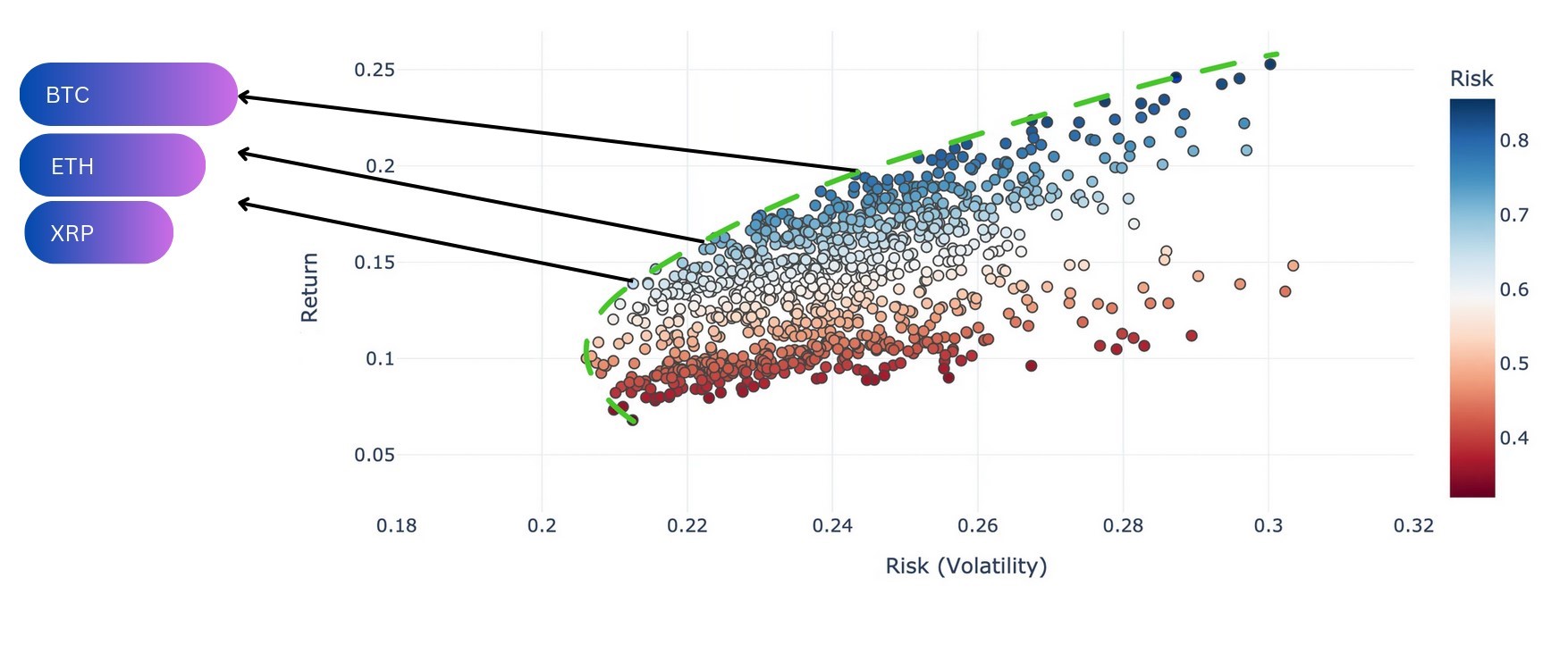

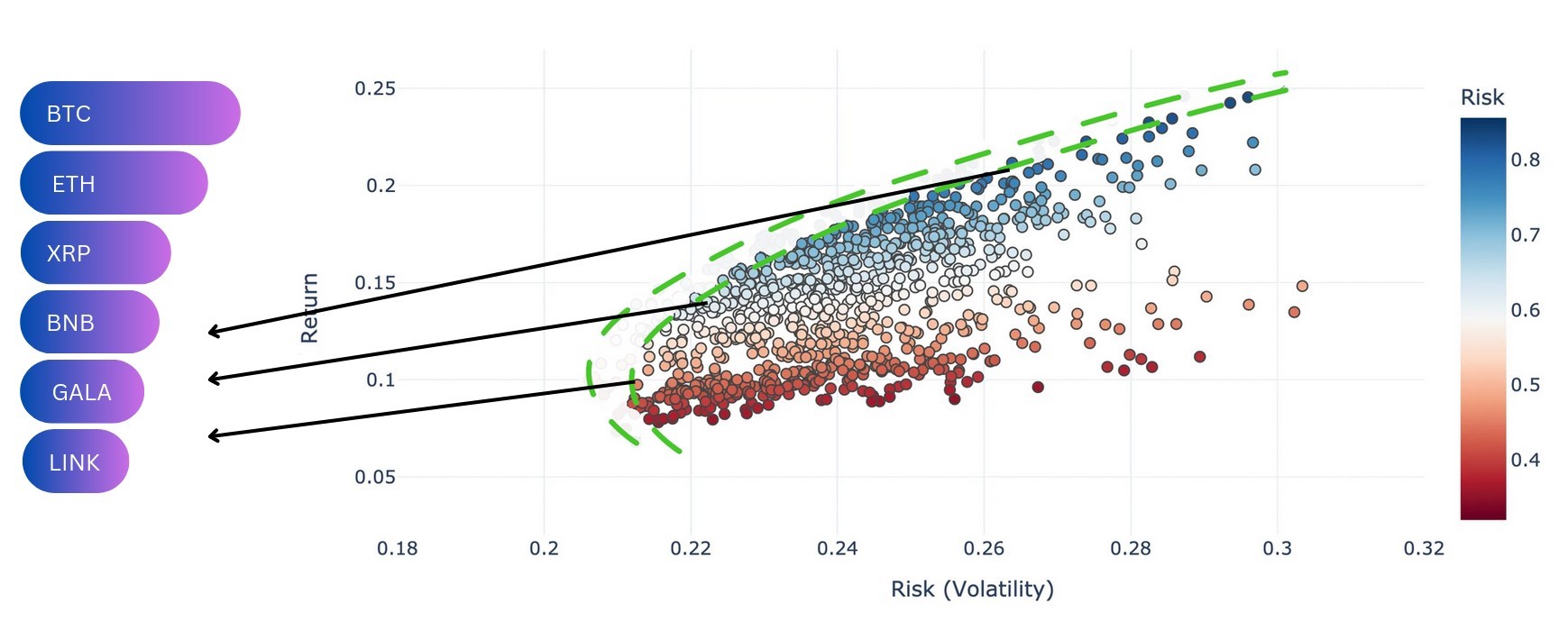

Nested-Efficient Frontiers

Selection in Evai Ratings

Evai uses a process called 'Nested-Efficient Frontiers Selection' to determine the best-performing cryptocurrencies. Think of it like peeling an onion. The outer layer (the top-ranking cryptocurrencies) is removed to reveal the next layer. This process continues, ranking each layer, or 'sub-efficient frontier', until all cryptocurrencies are ranked. Here's how it works:

Figure 3. - Finding the top one efficient frontier and retrieving the top coin (BTC) from it

Figure 4. - Finding the next of the nested-efficient frontiers and retrieving the top-performing coin from it

Figure 5. - Iterative continuation of finding the next sub-efficient frontiers and uncovering new hidden assets underneath, creating a ranked list of assets

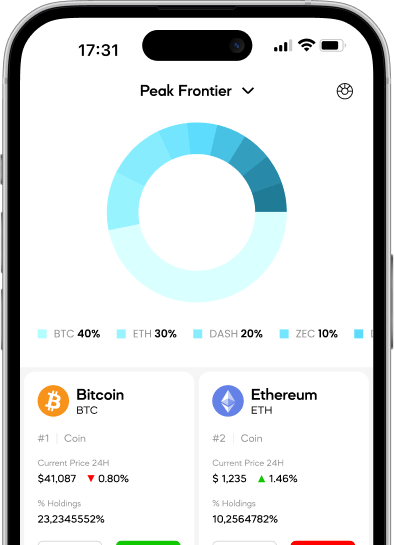

How to Benefit from

Evai Frontiers' Associated Products?

Conclusion

Evai's Nested-Efficient Frontiers Selection and Rating Scoring offers a dynamic and detailed way to evaluate cryptocurrencies. By continually refining the pool of assets and updating scores, Evai provides users with an up-to-date and comprehensive rating system and a suite of tools, making it easier to understand the potential performance of various cryptocurrencies and wisely create balanced portfolios based on solid numbers.