Evai Efficient

Frontier Intelligence

Evai Efficient Frontier Intelligence delivers institutional-grade AI analysis for over 1,000 crypto assets in real time, replacing entire analytical departments. Using advanced Q-functions and nonlinear profitability models, it uncovers hidden market opportunities and optimizes risk-reward strategies. From this intelligence, we extract Evai Crypto Ratings—unbiased evaluations for the entire market—and Evai Outliers, identifying the most powerful pumps. By adapting to crypto's unique market behaviors, it provides traders with cutting-edge, data-driven insights for smarter decisions.

Join the Evai Crypto

Ratings Evolution

The cryptocurrency market is filled with thousands of assets, but many hold unclear risks to users who are looking to build a profitable portfolio.

For most investors and institutions this uncertainty presents a major challenge in understanding their true value and assessing the risks and rewards associated with this dynamic asset class. Traditional financial ratings models currently applied to the sector are not fit for purpose, as they fail to take into account the complexities of digital assets relating to liquidity, slippage and on-chain metrics.

The Solution

Founded in 2019, Evai Ratings and Research has developed a a cutting-edge data and insights ecosystem, designed to make it easy for investors interact with the cryptocurrency market. Our approach to the market is built on a suite of intuitive tools and analytical models, each contributing to a holistic investment experience. Evai is a ratings agency built for the Web3 Era of investment. We analyse and rate digital assets, offering clear and reliable guidance using models designed to suit the demands of the market. Our aim is to demystify the complexities of digital asset investments, making them more accessible and understandable for investors. Ultimately, Evai's ratings are designed to be a trusted resource and universally accepted method of evaluating digital assets.

Here’s how it works

AI Crypto Ratings –

Your Unbiased Guide

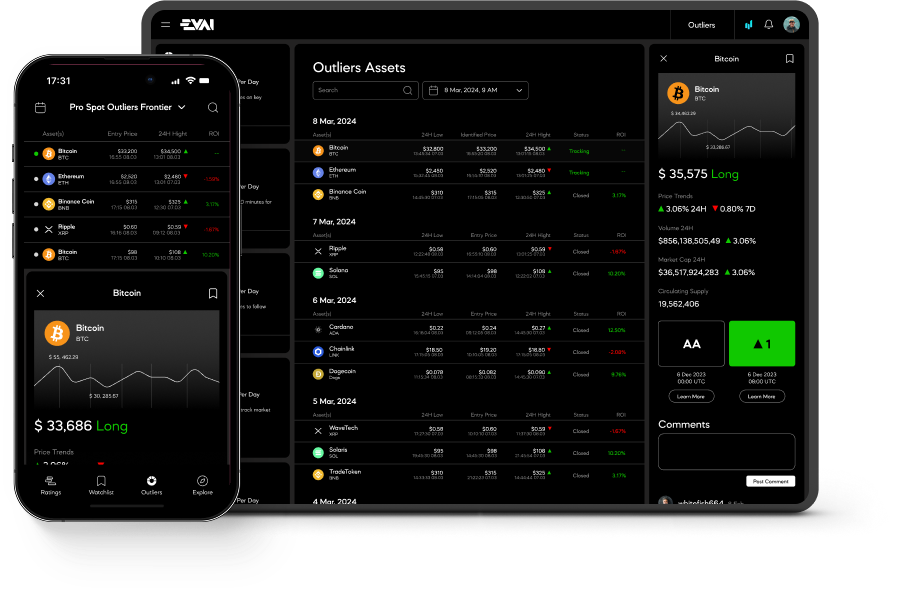

Powered by Artificial Intelligence, Evai Ratings provide real-time analysis of over 1,000 crypto assets, delivering unbiased, data-driven insights to investors. By continuously tracking market trends, risks, and opportunities, Evai Tools offer institutional-grade intelligence that can replace an entire analytical department—helping traders make faster, smarter, and more profitable decisions in a volatile market.

Evai Crypto Ratings –

Your Market Navigation

The Evai Crypto Rating tool scores assets from AAA down to D giving an indication of the underlying value and level of potential risk.

The ratings provide a guide that can be used to inform portfolio decision making. Every hour, EVAI’s innovative technology evaluates over 1,000 crypto assets against performance factors turning live market data into actionable insights. Increase your potential returns and minimize risk by using the power of advanced crypto ratings methodology to make smart investment decisions. Let our proven rating technology be your guide to the market.

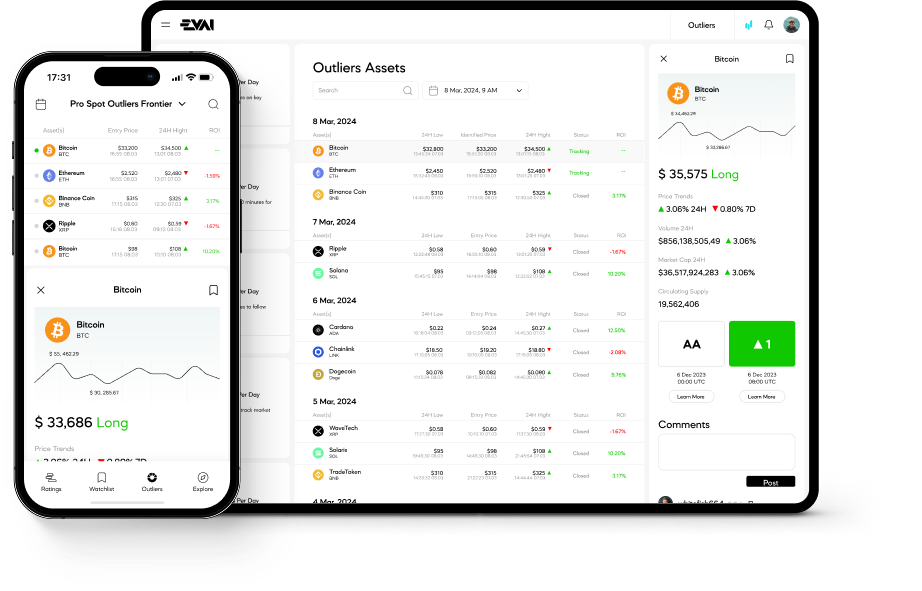

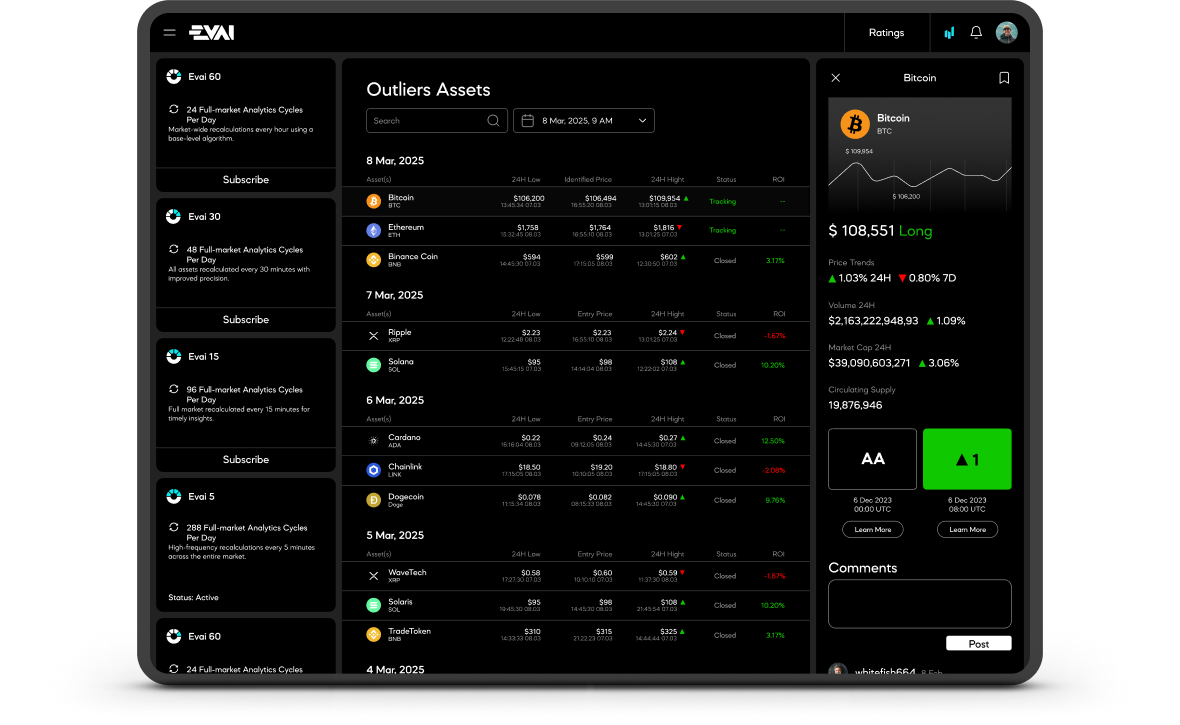

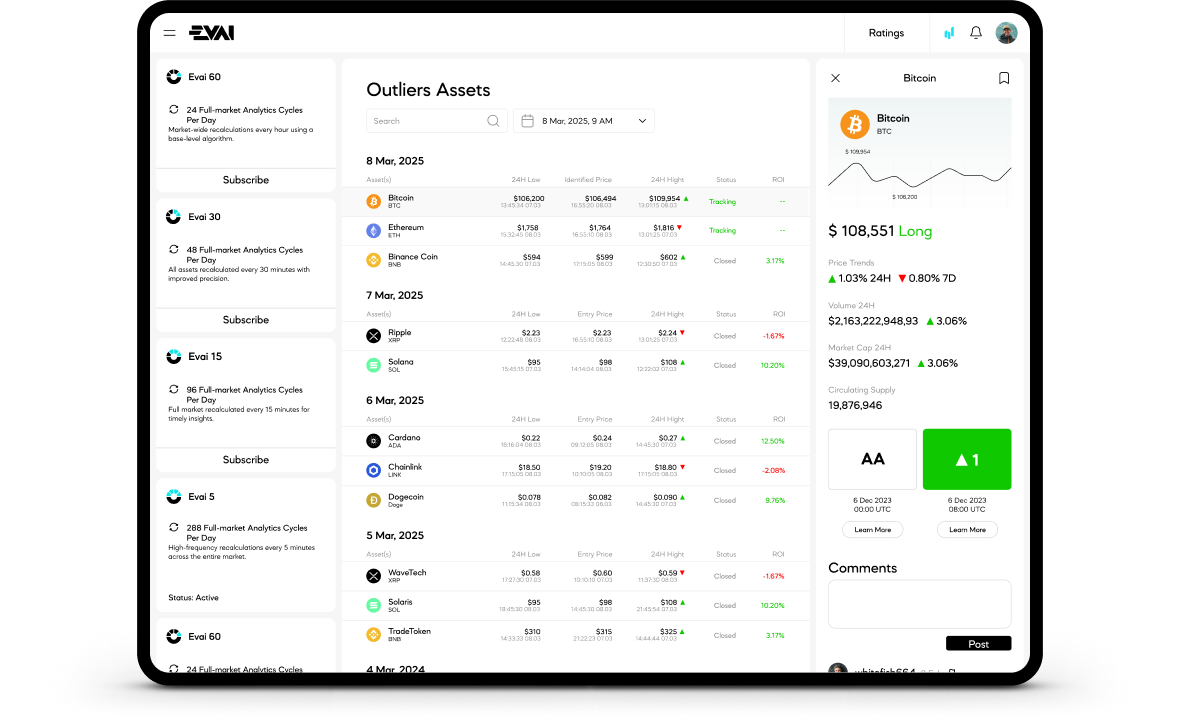

The New Frontier –

Evai Outliers

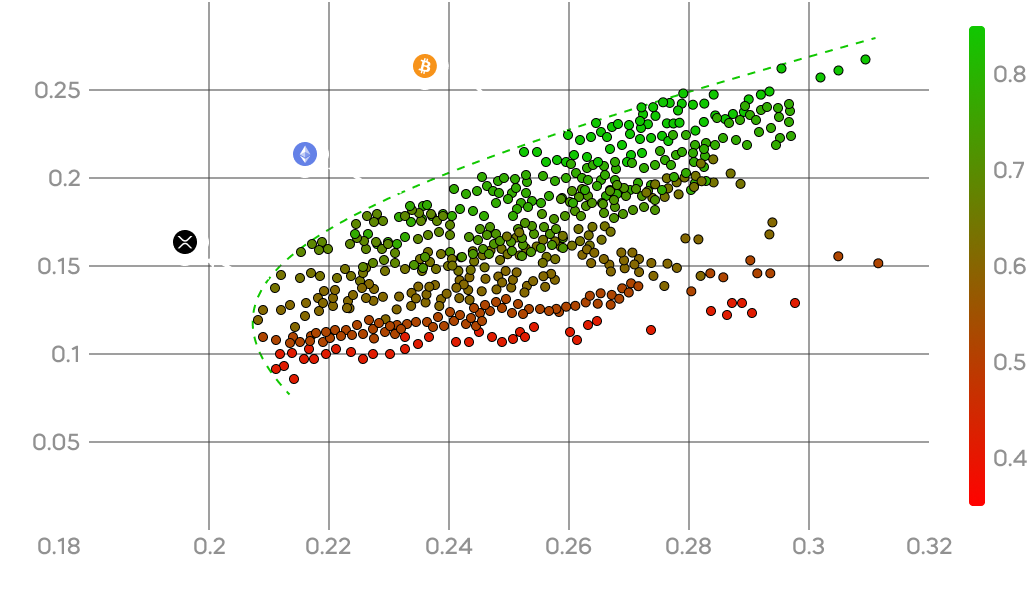

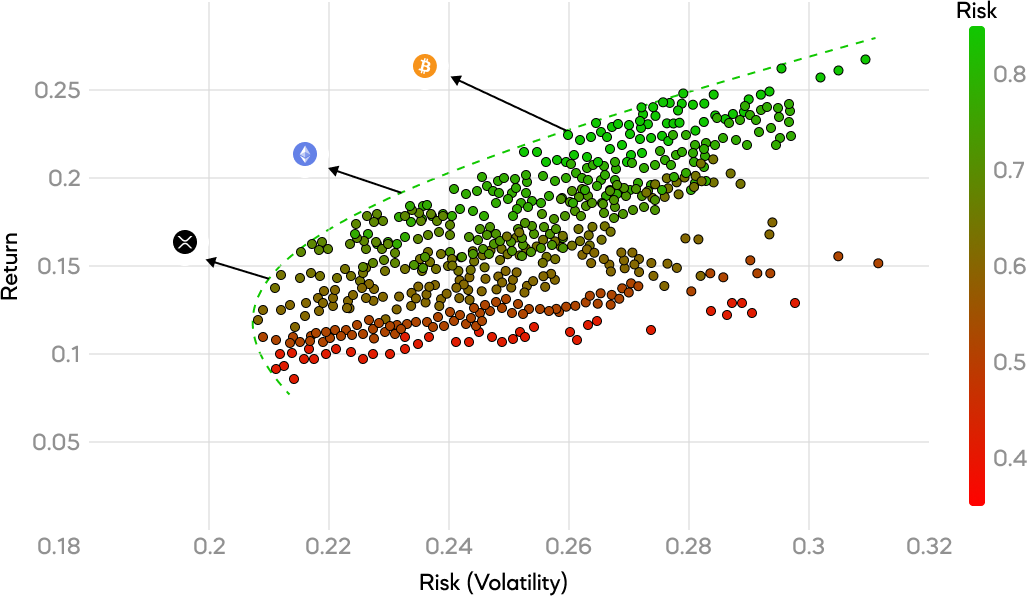

Timing the market and finding the next high-performing asset is a challenge for every investor. Evai Outliers is an advanced AI-powered tool designed to cut through market noise and detect assets with the strongest upward momentum. Unlike speculative predictions on the next 10x or 100x token, Evai Outliers leverages real-time data analysis to pinpoint digital assets with optimal liquidity and risk-adjusted growth potential.

To enhance accuracy and reduce risk exposure, Evai Outliers applies Efficient Frontier theory and AI-driven intelligence, providing traders with reliable, data-backed insights to capture the most promising market pumps.

Power Factors

Every asset rated by our proprietary AI and machine learning technology undergoes a rigorous evaluation that scrutinises the asset’s current data against nine Power Factors and over 20 further KPI’s.

Built on academic, peer-reviewed research and world-class, economically modelled technology, AI and machine learning cut through the noise, identifying risk and asset value based on each crypto asset’s live market data. Our Artificial Intelligence and machine learning select and combine indicators with optimal weightings to determine the greatest accuracy of each risk factor.